Fin-Wreck!

Published 21 July 2022

By Dr Peter J Phillips, Associate Professor (Finance & Banking) University of Southern Queensland

"As the half year ended, investors surveyed the damage. It was the worst start to a year for the U.S. markets since 1970."

In the first half of 2022, there was nowhere for investors to hide. Normally, investors can shift from one sector or asset class to another to protect their wealth. Or, since timing such shifts is very tricky, they can at least wish that they had made a couple of prudent moves. Worst comes to worst, you could put your money into cash and wait out the trouble. Not this time. Virtually everything went down. Even gold. And if you’re thinking cash was a good option, don’t forget about inflation. If you hold cash in America this year, you’ll lose (at least) 8 percent in real purchasing power. And bonds? No safety there either. The price of the U.S. 10-year bond fell 10 percent…the first time since 1974 that stocks and bonds fell in price together.

As the half year ended, investors surveyed the damage. It was the worst start to a year for the U.S. markets since 1970. The Dow Jones lost around 15 percent. The broader S&P 500 lost 21 percent. The 13 percent decline in the S&P 500 between January and April was the worst first four calendar months for the index since 1939. The tech-heavy NASDAQ lost 30 percent. The German DAX lost 17 percent. And our very own ASX 200 lost around 10 percent. While gold initially surged from $1,800 (U.S.) per ounce in January to $2,050 in March, it then began a sustained decline to $1,742. That’s 15 percent down from its March high. The only upside was in the energy sector, which tracked the surging oil price higher. Exxon Mobil stock is up 25 percent. Occidental Petroleum is up 87 percent. And Chevron is up 15 percent.

Leaving aside the stats, it is important to note the novelty of this experience for a generation of investors (possibly two generations). Such market carnage across the board, coupled with inflation and rising interest rates going into a weakening economy (something that central banks have never attempted before) is a new experience that many investors will find difficult to handle, both psychologically and financially. We expect that many investors would have responded by moving at least some of their money to cash, despite the inflation risk. Others might have been forced to sell to meet other obligations, including rising costs of living and higher mortgage repayments.

"Simply, booming markets means more amateur traders entering the fray and more money pouring in."

There has been a lot of talk in recent years about FinTech. This has quietened down as the ideas became mainstream and people began to understand that FinTech is not simply a combination of finance and technology (finance has always been at the cutting edge of technological developments) but a particular way of offering financial services. The FinTech industry is dominated by ‘payments’ firms. That is, companies specialising in transferring funds from person to person (usually internationally) at very low fees compared to traditional financial institutions. But FinTech is more than this. It also includes ‘pay later’ firms. These firms ran into some serious turbulence in 2022. Afterpay was bought out by the American firm, Block. Block’s share price has fallen more than 40 percent since the beginning of the year. Another Australian player, Zip’s stock has fallen 87 percent since January. Klarna, the Swedish FinTech firm and fellow ‘buy-now-pay-later’ firm, is a private company. That means we cannot observe its market value. However, the company was in the news in June as it reported a $748 million (US) loss and announced plans to lay off 10 percent of its workers.

Another interesting part of the FinTech ecosystem includes the firms that emerged after 2008 to offer investment and funds management services, including ‘robo-advice’ and cheap or commission-free trades. In general, we would expect these firms to follow the markets higher. Simply, booming markets means more amateur traders entering the fray and more money pouring in.

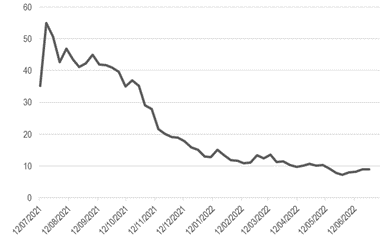

Let’s talk about Robinhood, the U.S. based FinTech. This firm’s main business is offering commission-free trades via a mobile app. It obviously doesn’t make money from commissions. It makes money by earning interest on customers’ cash balances and margin lending. Over the past year, the stock price has fallen by more than 70 percent, as the company repeatedly failed to meet earnings and revenue expectations:

While working on this post, I saw an advertisement on television for an Australian based FinTech firm called Raiz (formerly Acorns). The company’s main product is an investment app that, according to the company’s website, invests spare change from everyday purchases automatically into a diversified portfolio. If you read a little more, incidentally, you find that the company applies (among other things) the Markowitz algorithm that we have mentioned several times before. Goes to show that students interested in a career in FinTech still must study their finance classics!

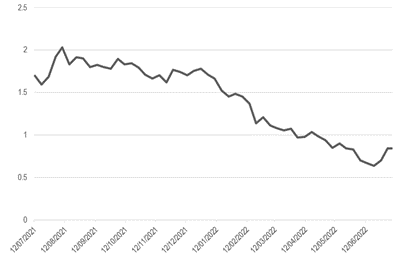

Leaving aside those investors who use Raiz’s app to invest, what about those investors who bought Raiz stock itself? Not surprisingly, the stock has followed the broader market down, losing about 50 percent of its value between January and July 2022. On the plus side, Raiz stock is trading off its lows and, in fact, advanced 30 percent (from $0.65 to $0.85) during late June and early July.

Of course, we are still in the middle of a very volatile period in market history. We have not seen anything like this for a long time. And many investors have never experienced such market and economic conditions, especially rising interest rates going into weaker economic conditions. Ultimately, we would expect the fundamental principles of investing to see investors through the turmoil if they can stick to them. And, years from now, the past six months will be a barely visible blip on the charts. If you don’t believe me, look at the Dow Jones chart for 1980 to 2022. If you didn’t know there was a crash (25 percent down on a single day) in 1987, would you be able to spot it?

Discussion Question

What other FinTech companies have been in the news? If they are public companies, how have their stock prices performed?

Further Reading

When prices are volatile, the charts become interesting. We outline some of the tools that ‘chartists’ use in Chapter 7 of the text.

Read other posts

Algorithms in Finance? That's Nothing New

The Algorithm that finds the ‘Best’ Portfolio

Why you should study Finance and Economics in the 21st Century

From Chicago to New York: Futures Trading and Microwave Popcorn

Basketball, Fund Managers, and the Hot Hand

The French Connection in Finance Theory

The Road to Cryptocurrency, Instalment # 1

The Road to Cryptocurrency Instalment #2

The Road to Cryptocurrency Instalment #3

The Road to Cryptocurrency Instalment #4

The Road to Cryptocurrency Instalment #5

The Road to Cryptocurrency Instalment #6

The Road to Cryptocurrency Instalment #7

Imagination and the Future of Cryptocurrency

Bigger Than FinTech: The Less Obvious Innovation Transforming Finance

NFTs: A Brave New World for Artists?

Sometimes, Inflatoin is the Only Way Out