What the Tech?

Published 11 February 2022

By Dr Peter J Phillips, Associate Professor (Finance & Banking) University of Southern Queensland

In November 2021, the tech-heavy NASDAQ hit 16,057 points. By late January 2022, the NASDAQ had lost 17 percent of its value. While tech stocks recovered somewhat in the first few weeks of February, at the time of writing (February 9, 2022), the NASDAQ was still down 12 percent from its 2021 highs.

This sharp correction in the tech sector was probably not unexpected. The NASDAQ had essentially tripled over the previous five years. A period of consolidation was overdue. More to the point, the spectre of rising interest rates in the United States prompted portfolio managers to reposition themselves, out of growth stocks and into other sectors. Take the money and run. At least for now.

The technical explanation for this lies simply in the relationship between future earnings and interest rates. The market value of a company depends on expectations about future earnings and the rate at which these cash flows are discounted. The risk-free rate of interest (e.g., the T-Bill yield) is a component of the discount rate. If T-bill yields go up, so does the discount rate, across the board. A higher discount rate applied to future earnings produces lower market valuations today. And the Federal Reserve is signalling an increase in rates.

"As the NASDAQ declined, some companies experienced a rougher ride than most."

While a broad tech sell-off is interesting, the fate of individual companies always makes for juicier reading. As the NASDAQ declined, some companies experienced a rougher ride than most. Take Amazon. Its stock price in mid-November 2021 stood at around $3,700 per share. By late January 2022, it was around $2,800. That’s a 25 percent drop, a good portion of which it has since recovered.

If that was enough to make a card-carrying member of the tech titan’s club, Jeff Bezos, think twice about purchasing his new yacht or launching his next spaceship, things were not much better over at Tesla, where Elon Musk’s company was off 30 percent from its 2021 high. Luckily, he had diversified into Bitcoin. But that didn’t have a good run through the latter part of 2021 either.

As dramatic as some of these sell-offs were, the most stunning was yet to come. This was the precipitous drop in value of Facebook (or Meta).

Back in 1970, Texan billionaire Ross Perot’s Electronic Data Systems (EDS), a company that would be absorbed under the Hewlett Packard umbrella in the late 2000s, was swept up in a broad-based market correction that saw Ross Perot personally lose $450 million on a single day as the value of EDS stock plummeted. At the time, this was a stunning, stunning loss.

"From its peak of $378, Facebook stock is down 42 percent. And it’s getting worse, not better as I write."

On February 3, 2022, Mark Zuckerberg personally lost around $32 billion as Facebook (or Meta) shares set valuation-wipe-out records. Zuckerberg owns around 13 percent of Facebook stock, or 375 million shares. When the stock fell by $80 per share, Zuckerberg personally lost 375,000,000 lots of $80 as the company overall lost almost $200 billion in market value.

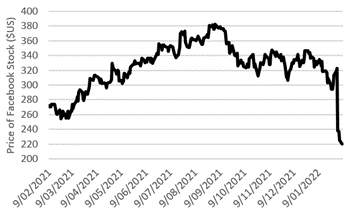

The main reason for the decline appears to have been disappointing earnings and, more significantly, Facebook’s first ever drop in users. Anyone paying even the slightest attention to the American social media space knows that there are many new companies emerging. Investors fear that this might be a big challenge for Facebook. From its peak of $378, Facebook stock is down 42 percent. And it’s getting worse, not better as I write. The chart of the Facebook stock price does not make for happy viewing, unless you’re a short seller:

Zuckerberg might, of course, take some comfort from Ross Perot’s story. EDS continued to grow, and Ross Perot went on to amass an even bigger fortune. In fact, in 1992 he was the wildcard in the 1992 US presidential election. At one point, he was in front of both Bush (senior) and Bill Clinton in the polls. Ultimately, Perot was the most successful third-party candidate since the early 1900s. He scored almost 20,000,000 votes (20 percent). George H.W. Bush scored 37.4 percent (approx. 39,000,000 votes) and Clinton, of course, was successful with approx. 45 million votes. Many people believe that Perot cost Bush the election.

Maybe Zuckerberg can one day throw his hat in the ring. But for now he’s got more pressing concerns.

Discussion Question

Was the NASDAQ’s correction predictable?

Further Reading

On the predictability question, see Chapter 7 of the textbook, especially the section on technical analysis. One might like to apply some of those technical or charting indicators to the NASDAQ index.

Read other posts

Algorithms in Finance? That's Nothing New

The Algorithm that finds the ‘Best’ Portfolio

Why you should study Finance and Economics in the 21st Century

From Chicago to New York: Futures Trading and Microwave Popcorn

Basketball, Fund Managers, and the Hot Hand

The French Connection in Finance Theory

The Road to Cryptocurrency, Instalment # 1

The Road to Cryptocurrency Instalment #2

The Road to Cryptocurrency Instalment #3

The Road to Cryptocurrency Instalment #4

The Road to Cryptocurrency Instalment #5

The Road to Cryptocurrency Instalment #6

The Road to Cryptocurrency Instalment #7

Imagination and the Future of Cryptocurrency

Bigger Than FinTech: The Less Obvious Innovation Transforming Finance