It is fair to say that the news cycle has been dominated by the coronavirus for much of 2021. International relations stories that might normally be given more attention have necessarily been accorded less. Even so, a few such stories have made regular appearances on the mainstream news platforms. One story is about Russian troops amassing near the Ukrainian border. The other is about Chinese aircraft over Taiwan. Both have been among the BBC’s “top” news story on occasions throughout the year.

While listening to one such news story, I heard the official being interviewed suggest that one of the measures that might be taken by Europe or the United States to deter Russia from considering any especially bold manoeuvres in Ukraine would be to cut off Russia’s access to the SWIFT system. Interestingly, reliance on SWIFT has long been considered by Russia as a strategic weakness and by their rivals in the West as a key strategic advantage.

"Each day, more than 40 million “messages” or payment orders relating to $5 trillion flow through the SWIFT system. A country suddenly excluded from the system would find the experience, in short, to be inconvenient."

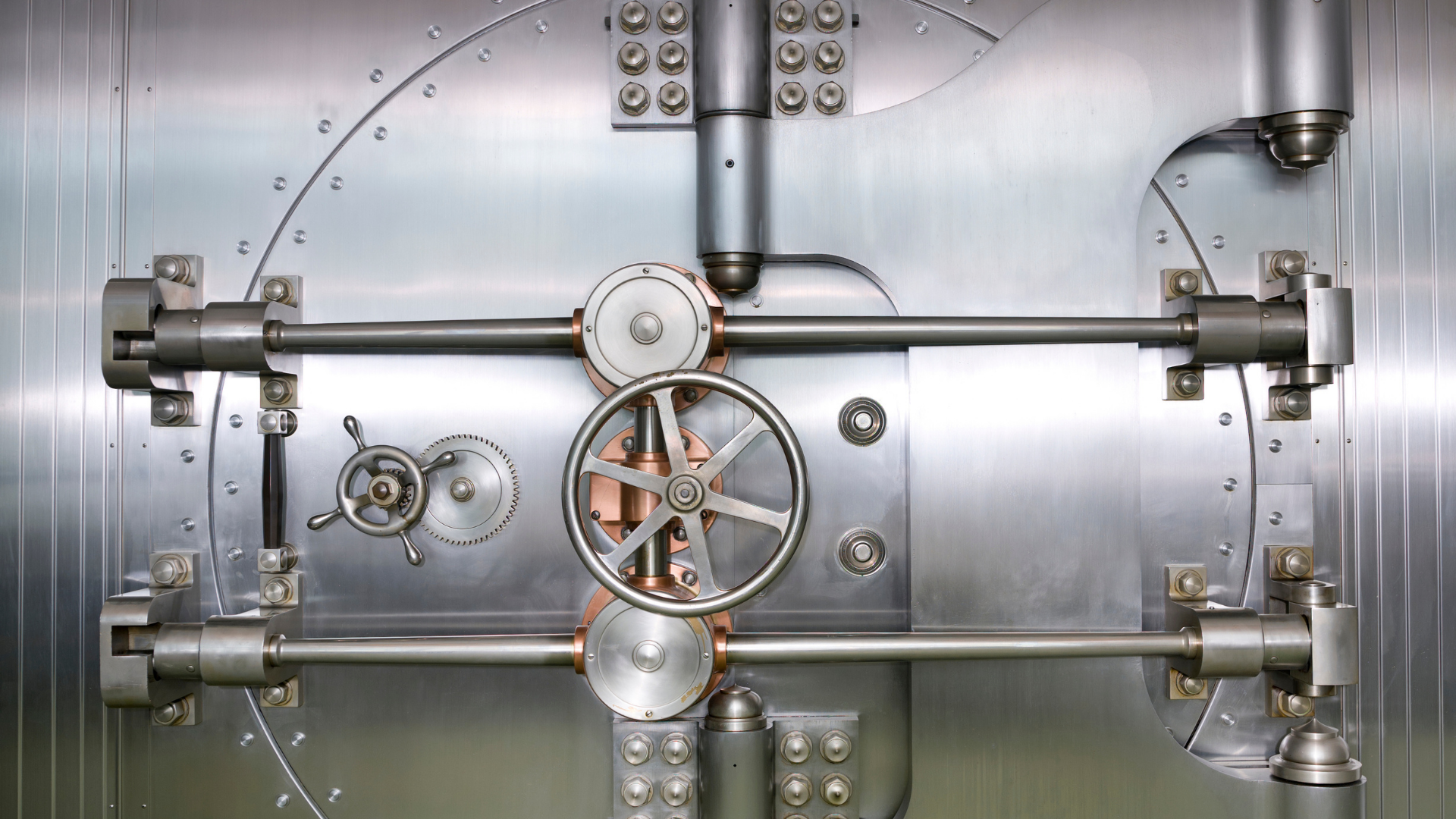

SWIFT or Society for Worldwide Interbank Financial Telecommunication was established in 1973 in Brussels with the support of 239 banks in 15 countries. It is owned by its member institutions. Each day, more than 40 million “messages” or payment orders relating to $5 trillion flow through the SWIFT system. A country suddenly excluded from the system would find the experience, in short, to be inconvenient.

It should be noted that SWIFT is not a funds transfer system. Rather it serves as a communications channel between financial institutions, allowing members to send and receive payment orders according to an agreed standard protocol that are then settled between members. If I want to transfer money from my Australian bank to a bank in Germany, I need to quote among other things the SWIFT code for the German bank. The SWIFT network facilitates the communication between banks, who then settle with each other according to my instructions.

The U.S. government does not control SWIFT. In fact, the SWIFT system was set up to avoid control of the international payments system falling into the hands of any single country or financial institution. Nevertheless, the U.S. government has substantial power if it chooses to wield it. Most notably, while the U.S. government cannot unilaterally prevent an institution or country from accessing SWIFT, it might enact sanctions against SWIFT to pressure SWIFT in some direction or other. In the early 2010s, under threat of U.S. sanctions, SWIFT blocked Iranian banks from using the network.

"...it is in evaluating the very decision to block a foreign government from access to SWIFT that the decision theory that underpins economics and finance might prove to be most useful."

While the use of similar tactics, whether directed ultimately towards Russia or some other country, is always a real possibility, the deeper story, I think, is the connection between finance and national security. Not only are there obvious connections, such as money laundering and terrorist financing, for instance, but there are deeper connections between finance, national security and decision-making that stem from the way in which communication, information, and human decisions are studied in economics and finance. We covered some of these in our opensource book on intelligence and counterintelligence decision-making.

In a previous instalment, I argued that economics and finance had applications beyond the financial markets and business due to their treatment of “information”. In fact, it is in evaluating the very decision to block a foreign government from access to SWIFT that the decision theory that underpins economics and finance might prove to be most useful. Decision theory is concerned with ranking alternatives under conditions of risk and uncertainty. The alternatives might be stocks or portfolios, but they might just as easily be alternative courses of action under consideration by governments in a national security context.

In deciding whether to prevent a government from accessing SWIFT, many things must be considered. These include the effectiveness of such a move, retaliation by the other side and the costs of such, interruptions to global trade and finance that might affect businesses in one’s own country and so forth. A few moments’ reflection reveals that many of the variables that must be considered in evaluating such a course of action against alternatives have a financial dimension. It would seem, therefore, that finance and national security are far from unrelated. The connection between them may become even more stark if international tensions rise.

Discussion Question

Are there alternatives to SWIFT? If so, couldn’t a foreign government or bank easily find a substitute?

Further Reading

We cover international finance, foreign exchange, and funds transfers in the series of chapters included in Part 5 of the textbook.

Read other posts

How Universities Shape the Real World: The Case of Corporate Finance

Disinformation: Can is Sweep Investors off their Feet?

Hedge Funds, Satellites and Empty Carparks

The Battle for FinTech Supremacy: The Tech Titans Vs the Masters of the Universe

Algorithms in Finance? That's Nothing New

The Algorithm that finds the ‘Best’ Portfolio

Why you should study Finance and Economics in the 21st Century

From Chicago to New York: Futures Trading and Microwave Popcorn

Basketball, Fund Managers, and the Hot Hand

The French Connection in Finance Theory

The Road to Cryptocurrency, Instalment # 1

The Road to Cryptocurrency Instalment #2

The Road to Cryptocurrency Instalment #3

The Road to Cryptocurrency Instalment #4

The Road to Cryptocurrency Instalment #5

The Road to Cryptocurrency Instalment #6

The Road to Cryptocurrency Instalment #7

Imagination and the Future of Cryptocurrency

Bigger Than FinTech: The Less Obvious Innovation Transforming Finance