Gamers Can’t Be Stopped?

Published 11 March 2022

By Dr Peter J Phillips, Associate Professor (Finance & Banking) University of Southern Queensland

Ross Perot is a name we’ve mentioned before. He was the founder of Electronic Data Systems (EDS), billionaire and one-time (1992) independent Presidential candidate. Somewhere along the line, in 1984, he helped two young entrepreneurs start a business called Babbage’s. The company’s name is a nod to Charles Babbage, the English mathematician who holds a special place in the history of computing. Starting out as a software retailer, the company quickly became focused on selling video games and consoles, riding the (fading) popularity of the Atari 2600 at first, before enjoying the long wave of innovation that would characterise the gaming industry for the next three decades.

Ultimately, through various corporate deals, including being acquired by the bookseller Barnes and Noble and then being spun off as an independent company, Babbage’s became GameStop. The company continued to grow by purchasing and absorbing various retail outfits. Australians will recognise the name Electronics Boutique, now EB Games, which was acquired by GameStop for $1.5 billion in 2005. EB Games was founded in the late 1970s in Philadelphia. By the time it was acquired by GameStop, it had expanded globally, including in Australia.

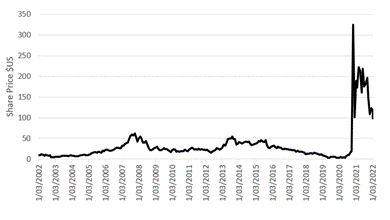

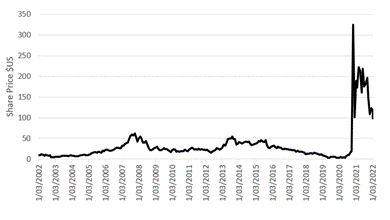

We can see from the price chart that GameStop shares experienced strong and continuous growth through the first decade of the 21st century. Gamers will know, of course, that this corresponds to the emergence of the “sixth generation” of video game consoles, including Microsoft’s Xbox and Sony’s PlayStation 2, in the first years of the 2000s, to be followed by the Xbox360 and PlayStation 3 in the mid-2000s. In fact, some people’s lives are structured around such product releases. The Commodore 64, the Nintendo’s Entertainment System, Sega’s Master System, the Super Nintendo, the Mega Drive (or Genesis), Nintendo 64, GameCube, Dreamcast. Like sands through an hourglass.

More to the point, by the 2000s, gaming was no longer a kid’s game. Adults with serious budgets to allocate to the pursuit were driving a multi-billion-dollar industry. Revenues currently stand at about $150 billion per year. By 2028, some estimates place the total expected market value of the companies that comprise computer game industry at around $600 billion.

Interestingly, though, we can see from GameStop’s share price chart that it flatlined in 2010 and began to drop. The reason for the decline is usually attributed to the competition GameStop faces from online platforms offering downloadable content rather than cartridges or CDs, or even download tokens, that are purchased in store. At the beginning of the Covid-19 pandemic in 2020, GameStop confronted what looked to be the ultimate conclusion of this train of events when physical stores were forced to close and potential customers were confined to their houses. The market value of the company, which had been as high as $4.7 billion in 2007 was just $304 million and expected to fall further.

And here we find the essence of one of the most storied events in GameStop’s history.

In early 2021, it was common knowledge that around 106 million shares had been sold short by traders expecting GameStop stock to fall to zero (or close to). This was against the 76 million shares on issue, leaving a short interest of more than 100 percent the total number of available shares.

In a series of events that is still being documented and will likely be talked about for decades to come, a group of Reddit users following a subreddit thread call r/wallstreetbets apparently realised that a short squeeze might be possible. A short squeeze occurs when the people who have sold the stock short have to buy stock to cover the stock they sold and curtail their losses as the stock price rises.

With such an extreme short interest of more than 100 percent of the outstanding shares, the conditions were ripe for a memorable event. Small investors, many thought to be following the subreddit thread but almost certainly joined by others who saw an opportunity, began buying GameStop stock in late December 2020. The price rose steadily from around $10 per share to around $20 per share. There was, in fact, a logical rationale for buying the stock. After all, the company still has considerable revenue and expecting it to quickly fade into oblivion is probably unrealistic.

As the price rose, the short sellers scrambled to cover their positions, buying more stock, and sending the price skyrocketing to as high as $483 per share on January 28, 2021. The short-sellers lost billions. The short position dropped to around 11 million shares, down from 106 million. After some wild swings, and a lot of interesting moves by trading platforms designed to stem the bleeding, the share price eventually settled down.

As of the time of writing, GameStop trades at around $100 per share, with a market value of $7.5 billion. A big improvement from early 2020 when the company looked to be on its knees. What the future holds is anyone’s guess but the emergence of market-movers from unlikely places is something that will probably become more common.

Discussion Question

Are there other ways, apart from short selling a company’s stock, that speculators can act on a belief that an asset’s price will fall?

Further Reading

Short selling is discussed at various points throughout the text. Consider, for instance, Chapters 19 and 20, on futures and options, where short positions are explained in context.

Read other posts

Algorithms in Finance? That's Nothing New

The Algorithm that finds the ‘Best’ Portfolio

Why you should study Finance and Economics in the 21st Century

From Chicago to New York: Futures Trading and Microwave Popcorn

Basketball, Fund Managers, and the Hot Hand

The French Connection in Finance Theory

The Road to Cryptocurrency, Instalment # 1

The Road to Cryptocurrency Instalment #2

The Road to Cryptocurrency Instalment #3

The Road to Cryptocurrency Instalment #4

The Road to Cryptocurrency Instalment #5

The Road to Cryptocurrency Instalment #6

The Road to Cryptocurrency Instalment #7

Imagination and the Future of Cryptocurrency

Bigger Than FinTech: The Less Obvious Innovation Transforming Finance