Fundamentals of Corporate Finance, 8e

Ross, Trayler, Hambusch, Koh, Glover, Westerfield, Jordan

ISBN: 9781743768051 (Print book) 9781743768082 (eBook)

Fundamentals of Corporate Finance 8e combines an applied introduction of concepts, with a clear and strong focus on learning outcomes.

Based on the principle that students’ understanding of corporate finance should be developed in terms of a few integrated and powerful ideas, it has 3 basic themes at its core:

- An emphasis on intuition: It separates and explains key principles on a common-sense, intuitive level before launching into specifics. The intuitive organisation of chapters also means that traditionally ‘more-difficult’ topics arise as a natural extension to the work that has gone before.

- A unified valuation approach: Net present value (NPV) is treated as the basic concept underlying corporate finance.

- A managerial focus: It emphasises the role of the financial manager as a decision maker, and the need for managerial input and judgement is stressed.

Up-to-date examples and cases in all chapters make the 8th edition a comprehensive manual of applied financial management, covering financial hot topics and focus areas, as well as a historic overview of developments in (and lessons learned from) equity and debt markets.

Cases focusing on well-known ANZ and international companies show how recognisable organisations put corporate finance into practice, and how real-world events such as the COVID-19 pandemic affect some of their corporate finance decisions.

This new edition is even more flexible than its predecessors, offering flexibility of coverage to unit coordinators in designing their courses.

Review copies will be distributed upon publication. Publication due April 2021.

What's new

New & Updated Content

- New local and international cases and examples from well-known international and Australian/New Zealand companies, showing students how they put corporate finance into practice and how real-world events such as the COVID-19 pandemic can affect corporate finance decisions.

- New and updated coverage of: clawbacks & deferred compensation; inversions; negative interest rates; Brexit as an illustration of political risk; and more…

- Incorporation of IFRS/AASB terminologies familiarise students with their use and help develop their understanding Australian financial reports.

Rich Pedagogy

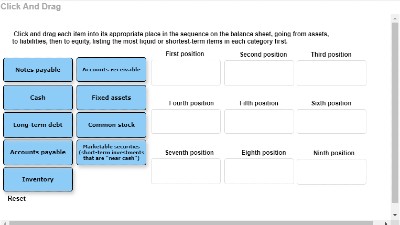

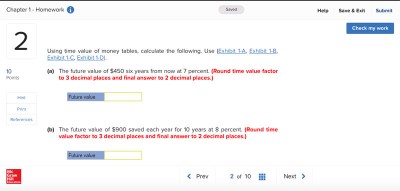

- Illustrations & tables included throughout, facilitate access to the subject matter – improving the student learning experience and facilitating the work of educators.

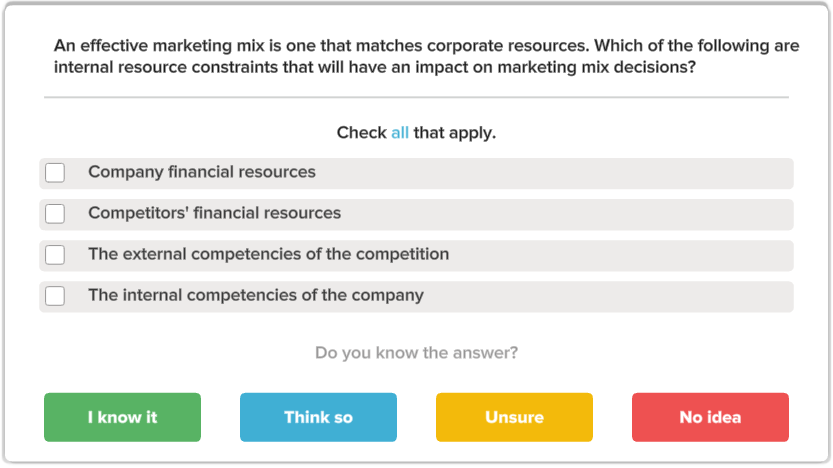

- End of chapter questions allow students to test their abilities and are now organised by level of difficulty.

- Chapter opening vignettes draw from regionally relevant real-world events, that introduce students to chapter concepts.

- Spreadsheet Strategies features introduce students to Excel and show them how to set-up spreadsheets to analyse common financial problems.

About the Australian authors

Rowan Trayler

Rowan Trayler was a Senior Lecturer in the UTS Business School at the University of Technology Sydney (UTS), retiring in 2016; however he is still involved in teaching in a casual position. He has held several administrative appointments, including Director of the Bachelor of Business and Director of the Master of Business in Finance. He has taught introductory finance courses to both undergraduate and postgraduate students at UTS for more than 30 years. His experience includes teaching small groups, executive MBA classes, and giving mass lectures for first year undergraduate finance students. He has also been a visiting lecturer at several universities in the United States and has conducted a number of in-house finance courses for non-finance executives.

Rowan has extensive experience in the banking and finance industry and has several international publications to his name in these areas. He was a member of the New South Wales state committee of the Australasian Institute of Banking and Finance from 2000 to 2005. Professionally, Rowan is a Fellow of the Financial Services Institute of Australasia and Fellow of the Certified Practising Accountants Australia.

His teaching philosophy is closely aligned to the writing style of the Ross text and this Australian adaptation incorporates that style. Rowan has a straightforward and well-designed approach to teaching introductory finance courses, which students appreciate, and he is keen to embrace new technologies in teaching, including web-based resources.

Charles Koh

Charles Koh co-ordinates and lectures postgraduate finance and professional accounting units with the Macquarie Business School at Macquarie University. He has also undertaken similar roles with the University of Sydney Business School at the University of Sydney. Charles has received several awards in teaching. His students have topped Australia in global professional examinations and recently won a university portfolio management competition.

Professionally, Charles is a Fellow of Financial Services Institute of Australasia and UK’s Association of Chartered Certified Accountants, a member of the Chartered Accountants Australia New Zealand, and a Member of the Australian Institute of Company Directors. He has authored articles principally on corporate governance themes, and organised university— industry conferences. Charles also technical edits, authors and co-authors a number of university finance and accounting titles. He did his Master of Business Administration (Finance major) at the Melbourne Business School (University of Melbourne), the AGSM (University of New South Wales), and Leonard N. Stern School of Business (New York University). He holds a Doctor of Business Administration degree from the University of Western Australia.

Prior to joining academia, he was a senior finance executive and was on the board of directors of a publicly listed group, and had consulted with Accenture. Charles also serves as a partner of a professional services firm, a trustee of a superannuation fund, and treasurer of a strata management committee. He was a committee member of the Sydney High School Foundation and an active member of the Association of Corporate Treasurers (Singapore).

Gerhard Hambusch

Gerhard Hambusch is a Senior Lecturer and Associate Head (External Engagement) in the Finance Department at the UTS Business School with research and teaching interests in Corporate Finance, Capital Markets, Banking and Ethics. His research publications include studies on leveraged investments and agency conflicts (Journal of Economic Dynamics and Control), the trade-off theory and effects of operating leverage (International Journal of Managerial Finance), momentum in sovereign bonds (Journal of Fixed Income) and forecasting bank leverage (Journal of Regulatory Economics). His excellence in teaching has been recognised through a citation from the Australian Government. Gerhard also manages the UTS Finance Department’s financial industry relationships.

Gerhard earned the right to use the Chartered Financial Analyst (CFA) designation and is a member of the CFA Institute and the CFA Society of Sydney since 2008. He serves as a volunteer and subject matter expert for CFA Institute, VA (USA) and is a member of the Australasia Advocacy Council formed by CFA Societies Australia and CFA Society New Zealand in 2016.

Before joining the UTS Business School, Gerhard completed his PhD at the University of Wyoming (USA). He also holds Master’s degrees from the University of Wyoming (USA), the Friedrich Alexander University Erlangen-Nuremberg (Germany) and the EM Strasbourg Business School (France). Financial industry experience includes supporting a funds-of- funds private equity portfolio managed in Frankfurt, Germany as well as supporting a middle- market buyout fund managed in Chicago, USA.

Kristoffer Glover

Kristoffer Glover is a senior lecturer in the finance department at the UTS Business School with research and teaching interests in Derivative Securities, Investment Analysis, and Corporate Finance. His research uses advanced modelling techniques to better understand the behaviour of financial market participants, from individual investors constructing their optimal investment portfolio, to companies deciding how best to exercise their managerial flexibility. His research has been published in many leading finance and mathematics journals and his teaching has been recognized through numerous UTS teaching citations, most recently in 2019.

Kris also obtained the Chartered Financial Analyst (CFA) designation in 2013 and is a member of the CFA Institute, as well as the CFA Society of Sydney. He also regularly serves as a volunteer and subject matter expert for CFA Institute (USA). Having a keen interest in understanding and managing risk, Kris is also a designated Financial Risk Manager (FRM). Before joining the UTS Business School, Kris completed a master’s degree in Mathematics and Physics and a PhD in Option Pricing from the University of Manchester in the UK.

Transform learning with adaptive online course materials that prepare students for real-world business challenges

Transform learning: boost grades, stimulate engagement and deliver an amazing course

Request a review copy

To request a review copy of Fundamentals of Corporate Finance 8e please complete the form below and your local Education Consultant will be in touch.